Home Buyers and Home Sellers Remain Active with a Solid Greater Nashville July 2025 Report

Middle Tennessee’s July housing activity produced a solid performance in overall value as well as activity.

MARKET CONDITIONSGREATER NASHVILLEMIDDLE TENNESSEE

Home Buyers and Home Sellers Remain Active with a Solid Greater Nashville July 2025 Report

Kenneth Bargers | August 8, 2025

Kenneth’s update 08082025… Middle Tennessee’s July housing activity produced a solid performance in overall value as well as activity within the key reporting segments of Closings, Pending Sales, Housing Inventory, Days on the Market, Values of Single-Family Dwellings and Condominium classifications. Housing inventory leads the reporting data as it offers an abundance of listing availabilities of 14,349. Closings increased M-T-M with 3,356 transactions. Values for Single-Family Dwellings and Condominium/Townhome classifications remain strong with median values of $524,700 and $344,900, respectively. Overall strong activity in the housing market for the month, and noticeable improvement from Y-T-Y.

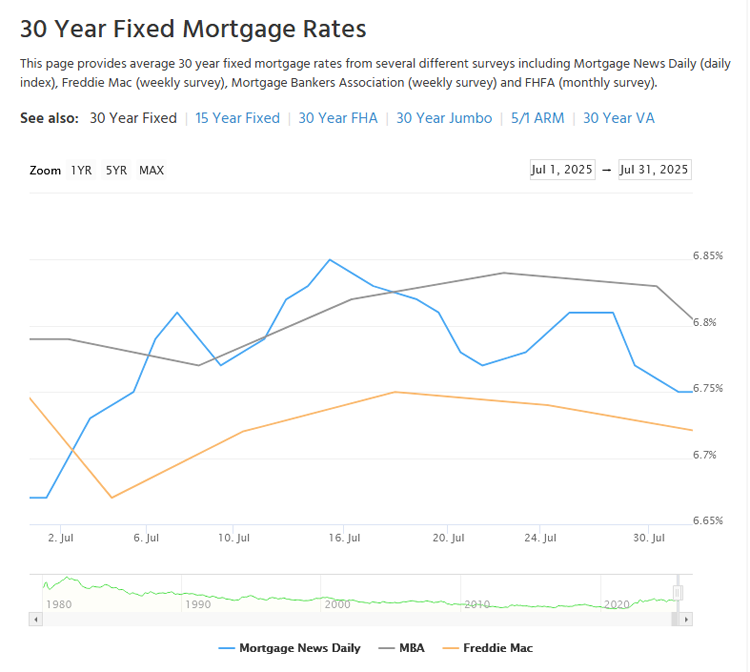

Mortgage rates ended the month lower and remained below 6.85% during the weekly reporting period from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). The following chart, courtesy of Mortgage News Daily, demonstrates the month’s flow for the Average 30-Year Fixed Mortgage Rates for the period of July 1, 2025, through July 31, 2025. The low daily-average reporting was 6.67% on July 1st, the high was 6.85% on July 15th, and month-ending reporting was 6.75% on July 30th.

How will mortgage rates react? National economic policies are noticeably affecting consumable goods with increased prices and should continue to challenge consumers’ daily living expenses with the influx of many tariffs now active that will influence price increases over the next several months. The combination of increased prices, future reduction of health insurance for millions of Americans, and the straining of the economic engine with disappointing reporting of data points including GDP, Labor Market Data, Inflation Report, and Consumer Confidence Index become a challenge for future housing market production. Will mortgage rates decrease with poor national economic performance to assist home buyers and home sellers?

Greater Nashville is a Solid Housing Investment. The Greater Nashville area offers diverse and solid economic conditions as an incentive for Buyers to invest in the Middle Tennessee real estate market, as well as an abundance of available listings and the month’s leveling of mortgage rates below 6.75%. It truly is a great opportunity to focus on the local conditions and for Buyers to take advantage of the current conditions. Should you jump into the real estate market? Contact your trusted lender to evaluate your home buying power dollars, and your favored REALTOR®, to discuss the current conditions and take advantage of the home buying and selling process.

The Greater Nashville REALTORS® recently released a report for the month ending July 31, 2025, as follows: There were 3,356 closings; 2,562 pending sales; 14,349 inventory; 50 days on the market; and the median price for single-family dwellings of $524,700, and $344,900 for condominium classifications. The data collected for this release represents nine Middle Tennessee counties: Cheatham, Davidson, Dickson, Maury, Robertson, Rutherford, Sumner, Williamson, and Wilson.

###

Pending home sales – Pending Home Sales is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing. Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales.

JULY 2025 REPORTING PERIOD SLIDESHOW https://youtu.be/S-eFLmYK0pQ?si=eb90XxzACmoFCkM6